To secure off-market deals in Alabama, start by driving for dollars, identifying distressed properties by their condition. Leverage real estate networks by connecting with agents and investors for exclusive opportunities. Explore public records for foreclosures and tax liens to find hidden gems. Utilize real estate software like PropStream and DealMachine to streamline your search and analysis. Finally, attend local auctions for direct access to undervalued properties. These strategic methods can uncover lucrative opportunities, giving you an edge in Alabama’s competitive real estate market. Each approach has unique advantages, offering deeper insights into maximizing your investment potential.

Key Takeaways

- Drive for Dollars to identify distressed properties by scouting for signs like neglected exteriors and overgrown lawns.

- Explore public records for foreclosure notices and tax lien information to discover potential off-market properties.

- Network with local real estate agents and investment groups for insider access to discreet off-market property opportunities.

- Utilize real estate software like PropStream and DealMachine to track and analyze off-market property data efficiently.

- Attend local auctions and engage with auction houses to find distressed properties sold below market value.

Drive for Dollars

Driving for dollars is a strategic approach that empowers you to uncover potential real estate deals by physically scouting neighborhoods for distressed properties. By identifying signs like broken windows, overgrown lawns, or neglected exteriors, you can spot homes owned by motivated sellers enthusiastic to sell at a discount. This method allows real estate investors to tap into off-market properties, often overlooked by competitors, and secure a good deal before it hits public listings.

As a savvy investor, you should aim to compile a thorough list of at least 500-1,000 distressed properties during your drives. This maximizes your outreach and boosts the chances of converting leads into successful deals. It’s vital to keep a consistent schedule, regularly driving through specific areas. This increases your likelihood of discovering new leads and staying ahead of competitors who are also on the hunt for good deals.

Understanding neighborhood conditions is fundamental. Firsthand knowledge of an area helps you assess the potential value of a property at a discount. Technology, such as smartphone apps, can streamline this process considerably. They allow you to track locations, take detailed notes, and organize potential leads efficiently. These tools guarantee you don’t miss out on promising opportunities and help you stay organized as you build your list of potential investments.

Leverage Real Estate Networks

To truly capitalize on off-market real estate deals in Alabama, leveraging real estate networks is indispensable. Networking with local real estate agents gives you insider access to off-market properties. These professionals often have direct relationships with sellers who prefer discreet sales. By forming solid connections with these agents, you can gain early access to properties that aren’t listed publicly, enhancing your real estate investment strategy.

Furthermore, engaging in real estate investment groups or clubs in Alabama can greatly expand your network. These groups often consist of seasoned investors who might have leads on pocket listings or upcoming opportunities. Sharing insights and resources within these communities can increase your chances of finding lucrative properties.

Consider integrating into community boards or social media groups focused on Alabama real estate. These platforms can be treasure troves for finding off-market deals from owners who wish to sell quietly. Additionally, these spaces encourage word-of-mouth referrals, providing a grassroots approach to uncovering hidden gems.

Here’s how to get started:

- Reach Out to Real Estate Agents: Cultivate relationships with agents who have a deep understanding of the local market and access to exclusive properties.

- Join Real Estate Groups: Participate in local investment clubs to connect with like-minded individuals who share off-market leads.

- Engage in Community Boards: Frequently check community forums and social media groups for potential deals shared by residents or other investors.

Explore Public Records

While building a robust network is a powerful strategy for finding off-market deals, don’t overlook the treasure trove of information available in public records. In Alabama, these records are an invaluable resource for uncovering distressed sellers and potential investment opportunities. Start your search at local courthouses to access foreclosure notices and tax lien information. These can indicate properties whose owners might be motivated to sell, offering you a chance to negotiate a favorable deal.

Diving into property tax records is another strategic move. By pinpointing owners with delinquent taxes, you can identify those who may be struggling financially. This financial pressure often translates into a willingness to sell, providing you with a prime opportunity to secure off-market properties before they hit the open market.

Don’t forget about probate cases. Court records associated with these can lead you to properties tied up in estate settlements. Executors or heirs might desire quick sales, giving you a chance to strike a deal on properties that haven’t yet been listed publicly.

Zoning and planning departments are also valuable for spotting investment opportunities. They maintain records on properties undergoing zoning changes or developments, which can signal future growth areas ripe for investment.

Lastly, forge connections with real estate professionals and local officials. Their frequent interactions with public records mean they could tip you off to opportunities you might otherwise miss. By strategically exploring public records, you can gain insights that position you ahead in the competitive Alabama real estate market.

Utilize Real Estate Software

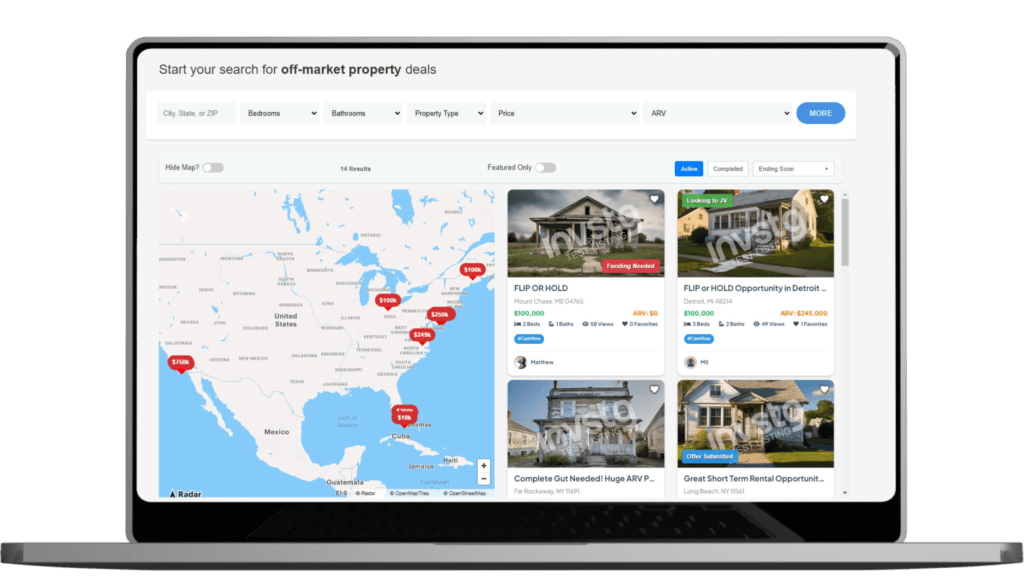

When seeking off-market deals in Alabama, leveraging real estate software can be a game changer in your investment strategy. By tapping into powerful tools like invstg, BatchLeads, DealMachine, and Mashvisor, you gain access to a wealth of property records and unique insights that can greatly enhance your real estate investing efforts.

When seeking off-market deals in Alabama, leveraging real estate software can be a game changer in your investment strategy. By tapping into powerful tools like invstg, BatchLeads, DealMachine, and Mashvisor, you gain access to a wealth of property records and unique insights that can greatly enhance your real estate investing efforts.

To start, PropStream offers an extensive database of over 155 million property records, enabling you to filter for off-market properties and conduct thorough investment property analysis. This can help you uncover lucrative opportunities hidden from traditional listings. Meanwhile, BatchLeads focuses on lead generation, providing access to more than 100 million property records to identify owners of off-market properties who might be ready to sell.

DealMachine stands out as a mobile app for tracking distressed homes while driving through neighborhoods. This tool allows you to spot potential off-market deals that aren’t publicly listed, giving you a competitive edge. Finally, Mashvisor combines data analytics with insights into local market trends, allowing you to assess property performance and zero in on off-market opportunities across Alabama.

Key Advantages of Using Real Estate Software:

- Comprehensive Access: Tools like PropStream and BatchLeads offer access to vast databases, making it easier to find off-market properties.

- Targeted Lead Generation: Software such as BatchLeads enables you to pinpoint and connect with property owners open to selling off-market.

- Enhanced Property Analysis: With Mashvisor, gain insights into local market trends and perform detailed investment property analysis.

Utilizing these real estate software tools streamlines your process, empowering you to identify and capitalize on off-market deals with efficiency and precision.

Attend Local Auctions

In addition to leveraging cutting-edge real estate software, exploring local auctions in Alabama can greatly enhance your strategy for securing off-market deals. Local auctions often showcase properties sold below market value, offering a prime opportunity for savvy investors like you. By attending these auctions, you can directly compete for off-market properties without facing the intense competition typical of traditional listings.

Local auctions frequently feature distressed properties or foreclosures. These scenarios often translate into significant savings and, consequently, the potential for higher returns on investment. As an investor, you can capitalize on these opportunities by understanding the nuances of auction dynamics and strategically positioning yourself in the bidding process.

One of the standout advantages of auctions is the immediate access to property details. This transparency allows you to assess multiple properties in a single day, enabling you to make informed decisions swiftly. It’s a time-efficient way to expand your portfolio, provided you approach it with a well-researched strategy.

Furthermore, engaging with local auction houses in Alabama keeps you informed about upcoming sales and exclusive listings not available through conventional platforms. This insider knowledge can be instrumental in staying ahead of the curve and identifying lucrative deals before others do.

To maximize your success, it’s essential to adopt a strategic approach to bidding. Set clear limits to avoid overextending financially and guarantee that any property you target aligns with your investment goals. By doing so, you’ll position yourself to secure off-market properties that promise substantial returns, enhancing your real estate investment strategy in Alabama.

Conclusion

Finding off-market deals in Alabama is all about being proactive and strategic. Remember, “fortune favors the bold.” By driving for dollars, leveraging real estate networks, exploring public records, utilizing software, and attending local auctions, you can uncover hidden opportunities others might miss. Each method enhances your real estate toolkit, giving you a competitive edge. So, plunge in, get creative, and watch as these strategies open doors to lucrative investment opportunities.