To find off-market real estate deals in New York, tap into hidden opportunities by exploring non-traditional avenues. Leverage real estate networks and build relationships with industry insiders for exclusive access. Use online platforms like ForSaleByOwner.com to discover properties with less competition. Engage directly with homeowners and analyze public records to target financially distressed properties and motivated sellers. Neighborhood scouting and understanding local market dynamics can expose potential deals often missed by others. Each method enhances your ability to negotiate favorable terms. For those keen to maximize investment potential, further exploration could reveal even more opportunities.

Key Takeaways

- Utilize online platforms like ForSaleByOwner.com and CityRealty for discovering off-market deals in New York.

- Engage with real estate specialists and attend industry events to access exclusive off-market opportunities.

- Conduct neighborhood scouting for distressed properties and engage directly with property owners for potential deals.

- Leverage public records and property tax data to identify financially distressed properties.

- Use technology and digital tools to streamline the search process for off-market properties.

Understanding Off-Market Properties

When you’re diving into the world of off-market properties, understanding their unique nature is essential to seizing potential opportunities. As a real estate investor, you’ll find that off-market properties in New York, totaling approximately 5,741,078, represent a vast landscape of hidden gems waiting to be discovered. These properties aren’t listed on the Multiple Listing Service (MLS), making them elusive yet potentially rewarding targets for those willing to dig deeper.

You might wonder why sellers choose this route. Often, they’re motivated sellers seeking privacy, wanting to avoid the public exposure that comes with traditional listings. This discretion can work to your advantage, as it often translates to less competition and a greater chance to negotiate favorable terms. These sellers might be dealing with distress factors—financial, physical, or legal issues—making them more open to discussions with serious buyers like you.

To uncover these opportunities, aligning with real estate professionals who specialize in off-market deals is vital. They’ll have access to specialized platforms and networks that reveal listings otherwise hidden from the public eye. By leveraging these resources, you position yourself strategically in the market, ahead of those relying solely on MLS listings.

Ultimately, understanding off-market properties requires a mix of patience, strategic partnerships, and a keen eye for detail. Approach this niche with optimism and a clear strategy, and you’ll find that these properties hold the potential to enhance your real estate portfolio considerably. Keep your focus sharp, and let each discovery guide you toward promising investment avenues.

Benefits of Off-Market Deals

Recognizing the unique characteristics of off-market properties opens the door to numerous advantages for investors. When you’re maneuvering through the bustling New York real estate market, off-market deals offer a strategic edge by reducing competition. With fewer bidders vying for the same property, your chances of securing a unique asset at an undervalued price increase considerably compared to traditional listings.

Another benefit is the opportunity to negotiate favorable terms. Motivated sellers in these exclusive deals often prioritize quick sales over maximizing profit, allowing you to tailor purchase agreements that best suit your investment needs. This flexibility can result in better purchase prices and conditions, giving you a competitive advantage.

The sheer volume of off-market properties in New York, boasting over 5.7 million options, provides a vast pool of investment opportunities. Unlike publicly advertised listings, these properties remain hidden gems, waiting for savvy investors like you to discover their potential.

Off-market transactions often include distressed properties, which can be a goldmine for those willing to invest in rehabilitation. These assets can be transformed into profitable ventures, aligning perfectly with a strategic investment approach focused on long-term gains.

Ultimately, off-market properties allow for personalized negotiations that aren’t possible in the public real estate market. By engaging in these exclusive deals, you’re not just buying a property; you’re investing in opportunities that can yield substantial returns. Embracing this approach can set you apart, positioning you as a forward-thinking investor ready to capitalize on New York’s dynamic real estate landscape.

Challenges and Risks

Steering off-market real estate deals in New York can present substantial challenges and risks, particularly due to their inherent lack of transparency. You might encounter undisclosed property issues or legal complications, which can be intimidating. The limited exposure of these properties often means fewer options, making it tough to find deals that meet your investment criteria.

To make informed decisions, you’ll need to tackle several key elements:

- Hidden Property Issues: Without the thorough disclosures typical in on-market listings, you risk encountering undisclosed maintenance or structural problems.

- Market Value Uncertainty: Determining the true market value is tricky without formal listings, increasing the risk of overpaying.

- Financing Hurdles: Securing financing can be challenging as lenders prefer MLS-listed properties with clear documentation.

However, don’t let these hurdles deter you. Approaching these deals strategically can turn potential pitfalls into opportunities. Performing diligent market research is vital to understanding the true market value and avoiding overpriced investments. Engaging in thorough due diligence, including detailed inspections and title checks, is essential to mitigate hidden risks. These steps guarantee you’re not blindsided by unpleasant surprises after the purchase.

While challenges abound, remember that each obstacle is a chance to refine your strategy and deepen your understanding of the market. With careful planning and execution, you can navigate these risks effectively. Embracing these challenges with a strategic mindset not only protects your investments but also positions you to capitalize on unique opportunities that off-market deals in New York can offer.

Leveraging Real Estate Networks

Tapping into the vast network of real estate professionals and enthusiasts in New York can reveal a treasure trove of off-market opportunities. By engaging with agents and brokers who specialize in these hidden gems, you gain access to exclusive deals not found on the MLS. Networking becomes your strategic tool, helping you connect with local investors and homebuyers at industry events and online forums, where you can uncover hidden off-market properties and even foster fruitful partnerships.

Consider this strategic approach:

| Strategy | Benefit |

|---|---|

| Engage Specialists | Access exclusive deals |

| Attend Events | Uncover hidden opportunities |

| Direct Outreach | Build homeowner connections |

Engaging directly with property owners through methods like “driving for dollars” can further enhance your network. As you physically scout neighborhoods for distressed properties, you create direct connections with homeowners who might be considering a sale. This engagement can lead to off-market deals that others might miss. Public records are another resource you shouldn’t overlook. They offer valuable insights into property ownership, enabling you to approach potential sellers directly.

Your optimism in leveraging these networks is key. The relationships you build with real estate professionals create a pipeline of opportunities, while your efforts at networking with property owners and fellow investors enhance your strategic reach. This proactive approach guarantees that you’re not just waiting for deals to come to you but actively creating them. By strategically positioning yourself within this network, you maximize your chances of discovering and securing lucrative off-market properties in New York.

Utilizing Online Platforms

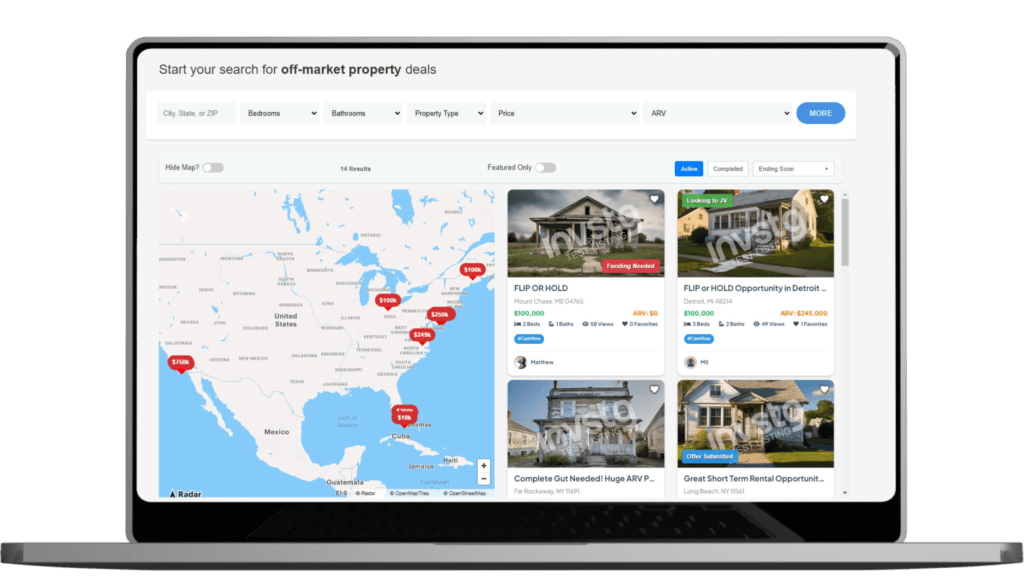

Although the traditional MLS remains a popular tool for real estate transactions, online platforms are revolutionizing the way you discover off-market deals in New York. These platforms offer innovative solutions that allow you to tap into exclusive opportunities not visible on mainstream listings. By strategically leveraging these digital resources, you can enhance your ability to find off-market properties with less competition and greater potential for profit.

Although the traditional MLS remains a popular tool for real estate transactions, online platforms are revolutionizing the way you discover off-market deals in New York. These platforms offer innovative solutions that allow you to tap into exclusive opportunities not visible on mainstream listings. By strategically leveraging these digital resources, you can enhance your ability to find off-market properties with less competition and greater potential for profit.

- invstg: This platform provides unique investment opportunities by listing off-market properties that aren’t found on traditional websites, giving you an edge in the competitive New York market.

- ForSaleByOwner.com: Facilitates direct connections between buyers and sellers, offering access to off-market listings and minimizing competition, which is essential for savvy investors.

- CityRealty: Specializes in insights into off-market properties in New York, enabling you to discover hidden gems that might otherwise go unnoticed.

Engaging with these online platforms is a strategic way to expand your reach within the real estate community. By using tools like Batch Leads, you can filter property data effectively, managing leads for off-market properties and identifying motivated sellers swiftly. The digital landscape also allows you to participate in online forums and virtual networking events, connecting you with other investors and real estate professionals keen to share insights and opportunities.

These platforms don’t just offer listings; they open doors to a broader real estate community, providing valuable insights and direct connections that traditional methods might miss. By embracing these tools, you’re positioning yourself at the forefront of finding off-market properties in New York, ensuring you stay ahead in this dynamic market.

Direct Seller Engagement

Direct seller engagement is a strategic approach that opens the door to a wealth of off-market real estate opportunities in New York. By connecting directly with sellers, you bypass traditional listing platforms like the MLS, tapping into a reservoir of over 5 million off-market properties. This method not only increases your chances of finding exclusive opportunities but also places you in a prime position to negotiate favorable terms.

Platforms like ForSaleByOwner.com are invaluable in facilitating these connections. They allow you to engage directly with homeowners, creating a more personalized negotiation process. This direct interaction often leads to better purchase terms and potential price reductions, as sellers may be more flexible when dealing directly with buyers.

Building relationships with homeowners in your targeted neighborhoods is another powerful strategy. Many homeowners might be considering a sale but haven’t listed their properties yet. By establishing a rapport, you can uncover hidden real estate deals before they hit the market. This proactive approach can grant you access to exclusive opportunities that others might miss.

Additionally, participating in local real estate events and community forums can be instrumental. These gatherings are fertile ground for meeting motivated sellers interested in discreet transactions. By positioning yourself as a knowledgeable and trustworthy buyer, you can attract sellers looking for a straightforward deal.

Embracing direct seller engagement not only enhances your chances of securing off-market properties but also provides a competitive edge in New York’s bustling real estate market. Your strategic initiative can lead to successful acquisitions in this dynamic landscape.

Exploring Public Records

Delving into public records can greatly enhance your strategy for uncovering off-market real estate deals in New York. By tapping into these resources, you gain access to invaluable information that can guide your investment decisions. Public records offer a wealth of data, including property tax records, foreclosure notices, and ownership information. Each element can be a critical component in identifying potential opportunities before they hit the open market.

Consider these strategic benefits of exploring public records:

- Property Tax Records: These records reveal ownership details and can highlight potential sellers, especially those who might be motivated to offload properties due to financial strain.

- Foreclosure Notices: By accessing these notices, you can pinpoint distressed properties that might be coming up for sale. This offers a chance to approach owners directly before the properties go into foreclosure auctions.

- Ownership Information: This data allows you to tailor your outreach, making your proposals more relevant and potentially more successful in securing a deal.

The online resources provided by New York’s Department of Finance make it easier than ever to access property assessment and ownership information. These tools can be pivotal in crafting a targeted approach to reaching potential sellers. Additionally, understanding zoning records and building permits can uncover properties ripe for redevelopment or reveal owners considering a sale due to ongoing renovations.

Harnessing the power of public records positions you to act strategically, giving you a competitive edge in the bustling New York real estate market. With this approach, you’re not just relying on luck; you’re building a methodical plan for success.

Neighborhood Scouting Techniques

To successfully uncover off-market deals, start by identifying distressed properties, as these often signal motivated sellers open to negotiations. Pay attention to local market trends by observing changes in neighborhood dynamics and property values, which can guide your investment strategy. Engaging directly with property owners through community events or casual conversations can also reveal hidden opportunities and establish valuable connections.

Identifying Distressed Properties

Unearthing off-market real estate opportunities in New York often begins with identifying distressed properties through strategic neighborhood scouting. Locating off-market deals is a skill that hinges on your ability to spot signs of neglect, like overgrown lawns or boarded-up windows. These signs can indicate properties ripe for investment. But don’t stop at just visual cues. Explore public records to uncover properties with unpaid taxes or mortgages, signaling potential financial distress that might motivate owners to sell quickly.

Consider adopting the “drive for dollars” approach. This involves driving through neighborhoods to spot distressed homes, noting addresses for further investigation. Engaging with local community members can also provide valuable insights. Mail carriers or store owners might know about properties showing signs of distress that aren’t publicly listed.

- Visible signs of neglect: Overgrown lawns, boarded-up windows.

- Public records: Unpaid taxes or mortgages.

- Community insights: Connect with locals for off-market leads.

Observing Local Market Trends

While identifying distressed properties lays the groundwork for discovering off-market real estate deals, understanding local market trends can greatly enhance your scouting efforts. By mastering neighborhood scouting techniques, you can pinpoint areas ripe with potential off-market properties. Investors looking to capitalize on these opportunities should diligently observe signs of financial distress—overgrown lawns, boarded windows, and neglected maintenance often signal motivated sellers.

Local Market Trends Analysis

| Technique | Benefit |

|---|---|

| Physical Exploration | Identify visible signs of distress in neighborhoods. |

| Public Records Investigation | Access data on liens and unpaid taxes for potential leads. |

| Community Engagement | Gain insider knowledge on upcoming off-market opportunities. |

| Real Estate Networking | Connect with investors for insights on specific areas. |

| Attend Local Workshops | Enhance networking and uncover potential deals. |

Utilizing public records is essential; they provide insights into properties with liens or unpaid taxes, potentially revealing off-market listings ready for quick sales. Engaging local community members and real estate pros can reveal insider knowledge about upcoming sales, often before they hit the market. Additionally, attending local real estate investment meetings or workshops opens networking avenues, connecting you with others who might have leads on off-market properties in specific neighborhoods. By strategically observing local market trends, you position yourself to uncover hidden gems in New York’s dynamic real estate landscape.

Engaging With Property Owners

When you’re engaging with property owners, understanding neighborhood scouting techniques is essential for identifying off-market real estate opportunities. By physically exploring neighborhoods, you can uncover unique opportunities within New York’s vast pool of 5,741,078 off-market properties. Keep an eye out for distressed or vacant properties, which often signal motivated sellers. Use these strategies to enhance your scouting:

- Visual Cues: Look for overgrown lawns, boarded windows, or “For Sale by Owner” signs. These signs can indicate property owners open to negotiation.

- Public Records: Access ownership and tax status information to spot property owners possibly facing financial distress, increasing your chances of discovering off-market properties.

- Community Engagement: Talk to neighbors and local businesses to gather insights about potential sellers who haven’t listed their properties yet.

Leverage personal connections by attending neighborhood events or homeowner association meetings. These interactions can reveal off-market opportunities, as community members might share insider information about property owners considering a sale. Strategically engaging with property owners and relying on these techniques will enhance your ability to secure off-market properties, offering you a competitive edge in the real estate market.

Identifying Distress Factors

When seeking off-market deals in New York, it’s essential to identify properties facing financial challenges like unpaid taxes or mortgages, as these often indicate motivated sellers. Keep an eye out for structural issues, which can present lucrative opportunities for renovation and value addition. Understand legal complications such as liens or zoning problems to strategically approach sellers enthusiastic to resolve their property woes swiftly.

Recognizing Financial Challenges

Identifying financial distress in real estate is essential for recognizing potential investment opportunities. When you’re on the lookout for off-market properties, understanding the signs of financial distress can be your key to discovering hidden gems. These distressed properties often result from unpaid taxes or mortgages, leading to decreased market value and increased buyer interest. Recognizing these opportunities requires a strategic approach, and here are some critical factors to evaluate:

- Foreclosure proceedings: Lenders reclaim properties due to non-payment, offering auction opportunities for savvy investors.

- Legal distress: Liens or zoning violations can complicate sales but may also lower purchase prices, creating potential for lucrative deals.

- Economic downturns: Increased distressed properties during downturns can open doors to unique investment opportunities.

Spotting Structural Issues

While exploring off-market real estate opportunities, it is crucial to focus on spotting structural issues that may indicate underlying distress factors. Identifying these red flags early can help you make informed decisions, ultimately safeguarding your investment. Foundation cracks are a significant concern in off-market properties, as they might signal substantial repair needs, potentially affecting the property’s value. Pay close attention to any signs of water damage, like stains on walls or ceilings. These could suggest plumbing issues or roof leaks, requiring thorough inspections to avoid unexpected costs.

Be vigilant for visible mold growth or musty odors, which often point to moisture problems. These can lead to costly remediation efforts, impacting your budget. Sagging ceilings or uneven floors may indicate structural instability, necessitating a professional assessment to evaluate repair costs and safety concerns. Don’t overlook homes with outdated electrical systems or insufficient wiring, as these might pose safety hazards and demand extensive upgrades to meet modern standards.

Understanding Legal Complications

Maneuvering the maze of legal complications in off-market real estate deals requires a strategic approach, as these issues can greatly affect your investment. Legal distress often arises from liens or zoning violations, which can complicate off-market transactions. Engaging with owners directly allows you to assess these challenges and negotiate terms that might lead to acquiring undervalued properties. Knowing how to identify and address these distress factors can position you favorably in the competitive New York market.

Consider these key points when managing legal challenges:

- Liens and Encumbrances: Properties with liens may offer lower prices, but require careful legal review to guarantee you’re not inheriting unresolved debts.

- Zoning Violations: Understanding local zoning laws can help you identify potential legal distress and negotiate terms that factor in the cost of compliance.

- Engaging Legal Counsel: A good real estate attorney can help untangle complex legal issues, providing clarity and protecting your investment.

Enhancing Negotiation Skills

To excel in off-market real estate negotiations in New York, it’s important to develop a strategic approach that capitalizes on understanding sellers’ unique motivations. By recognizing why sellers might choose to go off-market, such as financial distress or privacy concerns, you gain leverage. This insight allows you to tailor your negotiation strategies effectively. Keep a pulse on local market trends and property values, equipping yourself with the knowledge needed to make informed offers on off-market properties. This approach guarantees you avoid overpaying and secures deals that align with market realities.

Utilizing tools like Batch Leads can greatly enhance your negotiating prowess. These tools allow you to prioritize and filter leads, making sure your focus remains on the most promising off-market properties. By concentrating your efforts strategically, you increase the probability of successful transactions. Personalized communication is another important component. Building rapport with sellers through thoughtful, individualized interactions fosters trust, which is fundamental when negotiating off-market deals. When sellers feel understood and valued, they’re more likely to engage positively.

Active listening is a powerful tool in negotiations. By truly hearing what sellers express, you can uncover essential information about their needs and motivations. This understanding enables you to craft negotiation strategies that align with their goals, potentially leading to more favorable outcomes. Maintaining an optimistic and proactive mindset throughout the process will further enhance your ability to secure those prized off-market properties. With these strategies, you’re well-positioned to navigate the New York real estate landscape successfully.

Conclusion

In the quest for off-market real estate deals in New York, you’re like a skilled angler casting your line in uncharted waters. By strategically leveraging networks, online platforms, and public records, you can uncover hidden gems. While challenges exist, remember that fortune favors the bold. With enhanced negotiation skills and an eye for distress factors, you’ll turn potential obstacles into opportunities, securing valuable properties that others might overlook. Keep exploring, and success will follow.