Cap rate or cash on cash return both evaluate real estate investments, but their relevance depends on your goals. Cap rate (NOI ÷ market value) measures annual return potential, ideal for comparing properties or evaluating long-term income. Cash on cash return (annual pre-tax cash flow ÷ cash invested) focuses on actual cash yield, essential for leveraged investments or short-term profitability. Understanding when to prioritize each metric can refine your strategy. Exploring further will clarify how to balance these tools for smarter decisions.

Key Takeaways

- Cap rate evaluates potential return using NOI relative to market value, while cash on cash return measures actual cash flow relative to cash invested.

- Prioritize cap rate for assessing property value and long-term income potential without considering financing.

- Use cash on cash return to analyze leveraged investments and short-term profitability, factoring in financing costs.

- Cap rate is better for comparing properties in similar markets, while cash on cash return is ideal for immediate cash flow analysis.

- Combine both metrics for a comprehensive investment strategy, balancing long-term appreciation with short-term cash flow efficiency.

Understanding Cap Rate in Real Estate Investment

The capitalization rate (cap rate) serves as a key metric in real estate investment, calculated by dividing a property’s net operating income (NOI) by its current market value. It provides an annual return estimate, helping you assess its investment potential quickly. For multifamily properties, cap rates typically range from 4% to 7%, reflecting varying levels of risk and return. A higher cap rate often signals greater income potential but comes with increased risk, while a lower cap rate suggests stability and less volatility. When evaluating income-generating assets, comparing cap rates across comparable properties in the same market is essential. This allows you to make informed decisions based on relative property value and performance. Market conditions also play a significant role—cap rates may compress in high-demand areas where rising property prices reduce returns relative to investment costs. Rental market analysis is crucial for understanding factors that influence cap rates and making strategic investment decisions. Understanding cap rates helps you align your real estate investment strategy with your risk tolerance and financial goals.

Breaking Down Cash-on-Cash Return

You calculate cash-on-cash return by dividing the annual pre-tax cash flow by the total cash invested, which includes down payments, closing costs, and renovation expenses. The key components focus on accurate cash flow projections and precise accounting of the initial cash outlay. This formula guarantees you assess short-term profitability effectively, especially when leveraging financing.

Calculation Formula

When analyzing a property’s performance, cash-on-cash return provides a clear metric by dividing the annual pre-tax cash flow by the total cash invested. To calculate Cash-on-Cash Return, use the formula: Annual Pre-Tax Cash Flow / Total Cash Invested. Annual Pre-Tax Cash Flow equals the net operating income (NOI) minus the annual debt service, reflecting cash generated after financing. Total cash invested includes the down payment, closing costs, and renovation expenses. For instance, if your investment property yields $15,000 in annual cash flow and requires $250,000 in total cash invested, the Cash-on-Cash Return is 6%. Unlike Cap Rate, this metric focuses on actual cash received relative to your out-of-pocket investment, not the property’s market value. It’s particularly useful for real estate investors leveraging financing to assess short-term profitability and cash flow efficiency. Tools for property analysis can further enhance your ability to evaluate and optimize investment decisions.

Key Components

Understanding the key components of cash-on-cash return begins with breaking down its formula: annual pre-tax cash flow divided by total cash invested. The annual cash flow is derived from subtracting operating expenses and debt service from the net operating income, highlighting the actual cash generated by the property. total cash invested includes the down payment, closing costs, and initial renovation expenses, reflecting the upfront capital outlay. Unlike cap rate, which evaluates property performance without considering financing, cash-on-cash return incorporates leverage, making it a critical profitability metric for leveraged real estate investing. Higher percentages indicate more effective use of cash in generating income, aiding investment analysis by comparing property investments. This metric excels in short-term profitability assessments, focusing on immediate annual cash flow rather than long-term valuations. Early investment in house hacking can lower initial capital requirements, making it an accessible entry point for young investors.

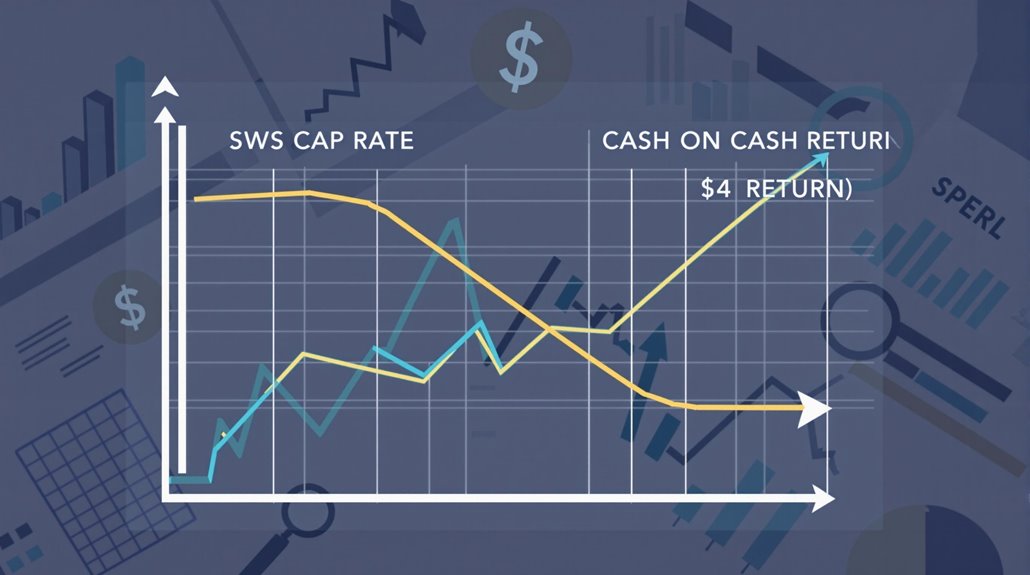

Key Differences Between Cap Rate and Cash on Cash Return

While both cap rate and cash-on-cash return evaluate investment performance, they focus on distinct financial aspects. Cap Rate measures the potential return of an investment property using net operating income (NOI) relative to its market value, offering a pre-financing perspective. It’s calculated as (NOI / Market Value) x 100, making it ideal for comparing properties without factoring in debt. Conversely, Cash on Cash Return assesses the actual cash flow generated relative to the cash invested, incorporating financing. Its formula is Annual Pre-Tax Cash Flow / Total Cash Invested, highlighting immediate cash flow efficiency. Cap Rate is favored for evaluating overall income potential and property value, while Cash on Cash Return emphasizes the impact of financing strategies on cash flow. Higher Cap Rates often signal greater potential return and risk, whereas higher Cash on Cash Returns indicate effective cash flow management and quicker recovery of invested capital. Choose the metric aligning with your investment priorities—property valuation or cash flow analysis. Understanding REITs can provide additional liquidity and passive income, complementing these metrics.

When to Prioritize Cap Rate or Cash on Cash Return

If you’re evaluating the income potential of an investment property without factoring in financing, prioritizing the cap rate can provide a clearer picture of its intrinsic value. Unlike Cash on Cash Return, which incorporates debt, the cap rate measures net operating income relative to market value, offering a straightforward evaluation of potential returns and investment risk. It’s particularly useful when comparing properties in similar markets or analyzing long-term income-generating capacity, as it removes the variability of financing decisions. This approach aligns with strategies that emphasize local market analysis to forecast trends and enhance investment returns.

- Compare properties: Use cap rate to evaluate how market value aligns with net operating income across similar investment properties.

- Debt-free analysis: Prioritize cap rate when evaluating properties not reliant on significant financing.

- Market valuation: Determine if a property is overpriced or undervalued based on its income stability.

- Long-term strategy: Leverage cap rate to gauge sustained income production, independent of financing fluctuations.

Situations Where Cash On Cash Return Is More Relevant

You’ll prioritize cash-on-cash return when analyzing leveraged property investments, as it factors in loan payments and highlights the actual cash yield on your out-of-pocket investment. This metric is indispensable if you’re focused on short-term profitability, as it measures annual cash flow relative to the cash you’ve directly invested. It guarantees you’re evaluating immediate returns rather than long-term market value assumptions. This approach aligns well with strategies like seller financing, where flexible terms can enhance short-term cash flow dynamics.

Leveraged Property Investments

When evaluating leveraged property investments, cash-on-cash return is a critical metric because it focuses specifically on the equity invested, providing a clear measure of pre-tax cash flow relative to the actual cash outlay. Unlike cap rate, which assesses property performance based on net operating income and total property value, cash-on-cash return accounts for financing costs, reflecting the true annual cash flow generated from your equity investment. This metric becomes particularly relevant in leveraged scenarios where a significant portion of the purchase is financed, as it highlights the return on the smaller equity portion rather than the entire property value. Using tools like the Long Term Rental Calculator can help investors accurately project cash flow and assess the viability of leveraged investments.

- Measures pre-tax cash flow relative to equity investment.

- Accounts for debt service and financing costs.

- Shows return on equity, not total property value.

- Provides insight into cash flow viability in fluctuating markets.

Short-Term Profitability Focus

Because cash-on-cash return emphasizes the relationship between equity investment and annual pre-tax cash flow, it’s especially valuable for investors prioritizing short-term profitability. Unlike cap rate, which evaluates property value relative to net operating income, cash-on-cash return focuses on the actual cash flow generated after debt service. This metric helps you assess how effectively your cash is deployed, particularly in leveraged scenarios where leverage impacts cash flow. By analyzing cash-on-cash return, you can determine how quickly you’ll recover your initial investment, a critical factor for maintaining liquidity in your investment strategy. It also enables you to identify potential cash flow issues and make informed decisions about property performance in volatile markets. For investors seeking immediate returns and liquidity, cash-on-cash return is a more actionable metric than cap rate. Medium-term rentals (MTRs) can enhance this strategy by providing consistent cash flow and reducing vacancy rates, further optimizing short-term profitability.

How Market Conditions Influence Both Metrics

Market conditions play a critical role in shaping both cap rates and cash-on-cash returns, as shifts in supply and demand directly influence property valuations and income potential. When demand outpaces supply, property prices rise, compressing cap rates, while oversupply can depress prices, leading to higher cap rates. Interest rates also greatly impact cash-on-cash return by increasing borrowing costs, which reduces cash flow for leveraged investments. Economic indicators, such as employment and wage growth, enhance rental income, positively affecting both metrics over time. Seasonal rental market fluctuations can cause short-term impacts on cash-on-cash return but leave cap rates relatively stable due to their long-term focus. Investors must consider the cyclical nature of real estate, as market conditions evolve, requiring ongoing investment evaluation.

- Rising demand lowers cap rates by driving up property prices.

- Interest rate hikes reduce cash-on-cash return by increasing loan costs.

- Strong economic indicators boost rental income, improving both metrics.

- Seasonal fluctuations temporarily affect cash flow but not cap rates.

Combining Metrics for a Comprehensive Investment Strategy

By integrating cap rate and cash on cash return, you can develop a more nuanced and well-rounded investment strategy that balances immediate financial performance with long-term potential. Cap rate evaluates a property’s market value and income potential within its market context, making it a key metric for analyzing long-term profitability. Meanwhile, cash-on-cash return focuses on cash flow efficiency, measuring the profitability of the actual cash you’ve invested. Together, these metrics provide a holistic view of property performance, ensuring you consider both immediate returns and future income potential. By leveraging both, you align your investment strategy with your financial goals, whether prioritizing steady cash flow or long-term appreciation. Combining these metrics with other indicators, like ROI and DSCR, further refines your understanding of the investment’s risk and return profile, enabling sharper, data-driven decisions.

Conclusion

In real estate, ignoring the interplay between cap rate and cash-on-cash return is like driving blindfolded—catastrophic and reckless. Cap rate measures asset value, while cash-on-cash return reveals your actual income relative to investment. Prioritize cap rate for long-term value but lean on cash-on-cash return for immediate cash flow clarity. Market fluctuations? They’ll crush you without both metrics. Combine them—nothing less than your financial survival depends on it.