When deciding between a DSCR loan and a hard money loan, you’ll find they serve distinct purposes. DSCR loans focus on long-term rental income, requiring a minimum 1.2 debt service coverage ratio and offering lower interest rates starting at 6.125%. Hard money loans are short-term, ideal for fix-and-flips, with rates typically above 9.5% and approvals based on property value, not credit. Understanding these nuances can help align the right financing with your investment strategy. Further insights will guide your decision-making.

Key Takeaways

- DSCR loans fund long-term rental properties, while hard money loans are short-term solutions for fix-and-flip projects.

- DSCR loans require a minimum DSCR of 1.2; hard money loans focus on property value, not credit scores.

- Interest rates for DSCR loans start at 6.125%, while hard money loans begin at 9.5% or higher.

- DSCR loans prioritize cash flow; hard money loans are based on property equity and resale potential.

- DSCR loans suit long-term rental income strategies; hard money loans are for immediate funding in property flips.

Overview of DSCR Loan vs Hard Money Loans

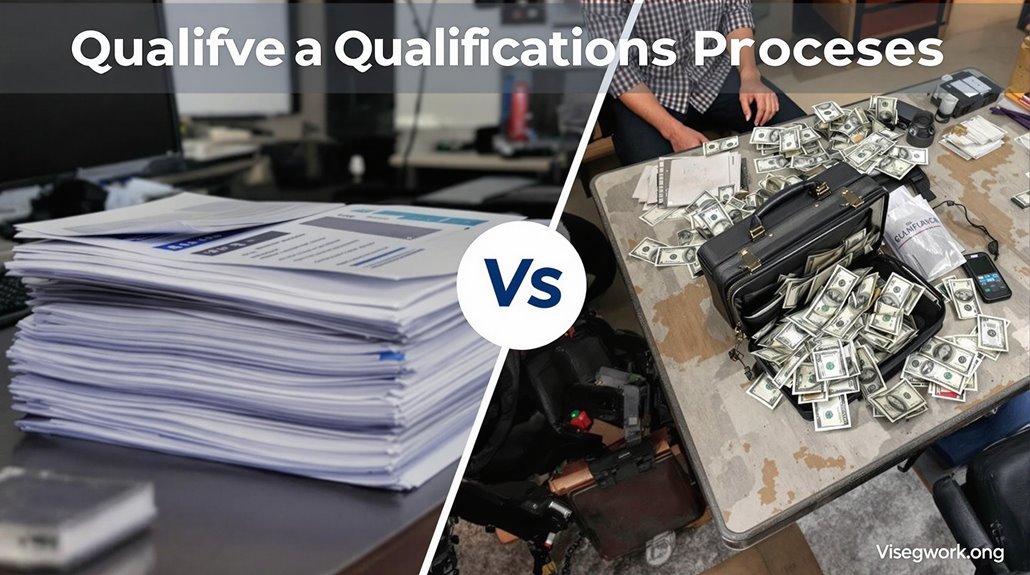

While both DSCR and hard money loans cater to real estate investors, they serve distinct purposes and have differing structures. DSCR loans are long-term financing options tailored for rental properties, focusing on the property’s cash flow to meet debt obligations. You’ll typically need a minimum DSCR ratio of 1.2 to qualify, as lenders assess the property’s income-generating potential rather than your creditworthiness. Interest rates for DSCR loans start at 6.125%, making them cost-effective for stable, income-focused real estate investments. Hard money loans, however, are short-term solutions often used for fix-and-flip projects. These loans prioritize the property’s value over cash flow or your credit history, offering quick access to capital with interest rates starting at 9.5%. They can cover up to 90% of purchase and rehab costs, making them ideal for time-sensitive opportunities. Both financing options provide flexibility for investors, but their structures align with specific real estate strategies. Hard money loans are particularly beneficial for beginner investors with limited financial history, as approval is based on the property’s after-repair value rather than personal credit scores.

Key Differences Between DSCR and Hard Money Loans

DSCR and hard money loans serve different purposes in real estate financing, with distinct structures and eligibility criteria. DSCR loans focus on long-term financing for rental income properties, requiring a minimum Debt Service Coverage Ratio (DSCR) of 1.2. Hard money loans cater to short-term financing needs, typically for property purchase and rehabilitation projects, relying on asset-based qualification criteria rather than rental income or creditworthiness. The interest rates for DSCR loans start lower (minimum 6.125%) compared to hard money loans (minimum 9.5%), reflecting the higher risk associated with the latter. Repayment terms also differ greatly, with DSCR loans offering up to 30 years and hard money loans limited to 18 months. When choosing between these options, consider whether your goal aligns with quick access to funds or a more structured, long-term investment strategy.

| Feature | DSCR Loans | Hard Money Loans |

|---|---|---|

| Purpose | Long-term financing | Short-term financing |

| Focus | Rental income | Asset-based |

| Interest Rates | Minimum 6.125% | Minimum 9.5% |

| Repayment Terms | Up to 30 years | Up to 18 months |

| Coverage | Up to 80% of purchase price | Up to 90% of purchase/rehab |

Loan Qualifications and Requirements

When applying for hard money loans, lenders primarily evaluate the property’s value as collateral, often disregarding credit scores or financial history. Loan qualifications for hard money loans focus on the investment property’s equity and potential resale value, allowing approval even with a poor borrower’s credit score. Down payment requirements are typically lower, covering up to 90% of the purchase price and 100% of rehab costs. In contrast, DSCR loans require a detailed analysis of the property’s cash flow and financial performance. Lenders assess the Debt Service Coverage Ratio, ensuring it meets or exceeds 1.2, indicating the property’s income can cover debt obligations. The underwriting process for DSCR loans is more rigorous, often necessitating higher credit scores and larger down payments. While hard money loans prioritize speed, DSCR loans emphasize stable financial performance and long-term viability.

Ideal Applications for Each Loan Type

You’ll find DSCR loans ideal for financing rental properties, as they emphasize long-term affordability and are assessed based on property cash flow rather than personal credit. Hard money loans, however, suit fix-and-flip projects better, offering quick funding and flexible terms tailored to short-term investment strategies. Choose the loan type that aligns with your investment timeline and project goals.

Rental Property Financing

Do NOT write placeholder text. Instead, write only what you are allowed to write.

For rental property financing, both DSCR and hard money loans serve distinct purposes based on the investor’s strategy and property needs. DSCR loans are ideal for investors focusing on long-term rental property financing, with repayment terms extending up to 30 years. These loans prioritize the property’s cash flow, requiring a minimum Debt Service Coverage Ratio (DSCR) of 1.2, ensuring rental income exceeds mortgage payments by at least 20%. They’re particularly advantageous if your personal credit is less than stellar, as underwriting emphasizes the property’s income potential. Conversely, hard money loans, while typically used for short-term projects, can finance rental properties in need of significant renovation costs. However, their shorter terms, often up to 18 months, make them less suitable for stable, long-term rental investments compared to DSCR loans. Additionally, down payment assistance programs can provide further financial support for investors aiming to minimize upfront costs in their rental property ventures.

Fix-and-Flip Projects

While DSCR loans are tailored for long-term rental property investments, hard money loans are the preferred option for fix-and-flip projects due to their short-term nature and flexibility. Hard money loans provide quick access to capital, allowing you to fund property improvements and resell the property within 12 to 18 months. Unlike DSCR loans, which prioritize stable rental income and long-term financing, hard money loans focus on the property’s after-repair value (ARV), making them ideal for renovation-focused projects. Ethical business practices ensure that all parties involved in hard money loan transactions benefit fairly from the deal arrangements.

- Hard money loans cover up to 90% of purchase prices and 100% of rehab costs.

- Financing is based on ARV rather than credit score.

- They’re short-term, typically 12-18 months.

- DSCR loans require a minimum 1.2 ratio, irrelevant for flips.

- Hard money loans align with the fast-paced financing needs of fix-and-flip projects.

Choose hard money loans for flips; DSCR loans for rentals.

Interest Rates and Loan Terms

When comparing hard money loans and DSCR loans, interest rates and loan terms considerably differ due to their distinct structures and purposes. Hard money loans typically start with interest rates at 9.5% or higher, reflecting their short-term nature and reliance on asset-based lending. In contrast, DSCR loans often begin at 6.125%, as they evaluate rental income coverage for mortgage payments, reducing lender risk. Repayment terms for hard money loans usually max out at 18 months, making them ideal for quick-turnaround projects. DSCR loans, designed for long-term financing, extend up to 30 years, offering stability for investors seeking predictable cash flow. Additionally, hard money loans often include higher overall expenses due to additional fees, while DSCR loans prioritize affordability in their cost structure. Your choice hinges on the project’s timeline and financial strategy. Considering average interest rates of 12.5% for hard money loans can significantly impact overall borrowing costs.

Choosing the Right Loan for Your Investment Strategy

You must assess your investment goals to determine whether a DSCR or hard money loan aligns with your strategy. Evaluate loan term considerations, as DSCR loans support long-term rental income, while hard money loans suit short-term property flips. Match loan features, such as underwriting criteria and repayment flexibility, to your financial position and project timeline.

Assessing Investment Goals

How do investment goals influence the selection between a DSCR loan and a hard money loan? Your investment goals determine which loan aligns with your strategy. DSCR loans are ideal for long-term rental income, offering lower interest rates and extended terms, while hard money loans cater to short-term property acquisitions or renovations with rapid funding and higher interest rates.

- Rental Income: DSCR loans require a debt service coverage ratio of at least 1.2, ensuring sustainable cash flow potential.

- Property Acquisitions: Hard money loans provide quick access to capital for purchasing or rehabilitating properties.

- Interest Rates: DSCR loans start at 6.125%, while hard money loans begin at 9.5%.

- Long-Term Holding: DSCR loans support long-term rental strategies with terms up to 30 years.

- Short-Term Projects: Hard money loans suit fix-and-flip projects with terms up to 18 months.

Considering real estate crowdfunding can be a low-risk alternative for investors seeking collaborative opportunities without direct property ownership.

Loan Term Considerations

Your investment goals influence not only the type of loan you choose but also the term that aligns with your strategy. DSCR loans are structured for long-term financing, with repayment terms extending up to 30 years, making them suitable for maintaining rental properties and optimizing cash flow management. In contrast, hard money loans focus on short-term financing, providing quick capital with terms typically up to 18 months, ideal for fix-and-flip projects demanding immediate liquidity. Below is a comparison of key loan term aspects:

| Feature | DSCR Loans | Hard Money Loans |

|---|---|---|

| Loan Term | Up to 30 years | Up to 18 months |

| Interest Rates | Lower, fixed or variable | Higher, risk-adjusted |

| Purpose | Long-term rentals | Short-term investments |

| Cash Flow | Stable, lower payments | Quick, high returns |

Choose a loan term that supports your investment strategy and financial objectives.

Matching Loan Features

When selecting a loan to match your investment strategy, it is essential to evaluate the key features, including term length, interest rates, qualifications, and loan-to-value (LTV) ratios. Hard money loans cater to short-term projects with higher interest rates, while DSCR loans focus on long-term financing for rental properties with lower rates. Your financing choice should align with your investment goals and the property’s income potential. Considering investments in high-yield savings accounts can provide additional low-risk income streams to support your financial strategy.

- Term Length: Hard money loans typically span 12–18 months, whereas DSCR loans extend up to 30 years.

- Interest Rates: Hard money loans start at 9.5%, while DSCR loans begin around 6.125%.

- Qualifications: Hard money loans prioritize property value; DSCR loans require a debt service coverage ratio of 1.2.

- LTV Ratio: Hard money loans accommodate up to 90% LTV; DSCR loans cap at 80%.

- Cash Flow Focus: DSCR loans emphasize rental income, ensuring sustainable cash flow.

Conclusion

Picture your investment as a ship maneuvering through choppy financial waters—choose the right loan to steer its course. A DSCR loan offers stability with predictable payments, anchoring your cash flow. Alternatively, a hard money loan is a swift sail, ideal for quick acquisitions or renovations. Assess your goals, credit profile, and timelines carefully. Remember, the right loan isn’t just a lifeline; it’s the compass guiding your portfolio to calmer, profitable shores.