To find off-market real estate deals in Michigan, focus on strategic networking and data analysis. With around 86,666 off-market opportunities available, prioritize connecting with real estate agents and investors to uncover hidden deals. Analyze local tax records to identify distressed properties early. Leverage platforms like PropStream and Foreclosure.com to access detailed off-market property databases. Take advantage of the reduced competition and negotiate effectively, framing offers based on the seller’s motivations. Guarantee thorough due diligence for potential risks, and explore flexible financing solutions like hard money loans. There’s a wealth of strategies to enhance your off-market success.

Key Takeaways

- Network with real estate agents and investors to discover off-market property opportunities in Michigan.

- Consult local tax records to identify distressed properties not publicly listed.

- Use platforms like PropStream and Foreclosure.com for databases of off-market listings.

- Join online forums and social media groups to connect with investors knowledgeable in off-market deals.

- Attend real estate auctions to uncover potential off-market property investments in Michigan.

Understanding Off-Market Deals

When delving into off-market real estate deals in Michigan, it’s crucial to grasp their unique dynamics and strategic advantages. Off-market properties, totaling approximately 86,666 in the state, present distinctive investment opportunities hidden from the public eye. Understanding these dynamics requires recognizing the motivations of sellers, which often include financial distress, property condition issues, or a desire for privacy.

To effectively navigate this landscape, you need to be aware that sellers might be driven by situations like foreclosure or tax liens, which can create urgency. Such conditions often lead to properties ranging from those needing minor repairs to those requiring significant renovations. This understanding allows you to approach negotiations strategically, knowing that the limited competition typical of off-market deals can result in better terms and potentially lower purchase prices.

Finding these off-market properties involves a combination of strategic tools and techniques. Direct mail campaigns can be a powerful method to reach out to potential sellers directly, while effectively leveraging your network can uncover opportunities before they hit the market. Additionally, scrutinizing local tax records can reveal properties in distress, offering another avenue to identify potential deals.

Benefits of Off-Market Properties

Although the world of real estate is vast, off-market properties in Michigan offer distinct advantages that can greatly enhance your investment strategy. One of the primary benefits is reduced competition. These properties aren’t listed on the multiple listing service (MLS), meaning fewer buyers are aware of them. This limited visibility often leads to lower purchase prices and better negotiation opportunities. By targeting off-market properties in Michigan, you can negotiate terms more favorable to your financial goals.

Investors like you can also tap into unique investment opportunities. With approximately 86,666 off-market properties available, you have a broader pool to explore, full of hidden gems not found in traditional listings. These properties often include distressed assets, which can be acquired at undervalued prices, paving the way for higher returns on investment. By identifying these undervalued assets, you can strategically position yourself for substantial financial gains.

Moreover, working directly with motivated sellers can smooth the negotiation process. Sellers of off-market properties often seek quick transactions, enabling you to secure deals with favorable terms. This direct interaction can streamline the buying process, allowing for more personalized agreements that benefit both parties.

Finally, the limited market visibility of off-market properties in Michigan presents a unique opportunity. By venturing into this less-explored territory, you can secure deals that aren’t available through traditional listings. This strategic approach can be a cornerstone of a successful investment strategy, offering you a competitive edge in the dynamic real estate market.

Finding Off-Market Opportunities

To effectively uncover off-market opportunities in Michigan, start by strategically networking with real estate agents and investors who can provide access to hidden deals among the 86,666 available properties. Directly target distressed properties by exploring local tax records, which often reveal potential sellers not yet on the public market. This combined approach maximizes your chances of discovering unique investment prospects that others might overlook.

Networking for Hidden Deals

Networking is a strategic cornerstone in uncovering off-market real estate opportunities in Michigan. By connecting with local real estate agents and investors, you gain access to exclusive properties in Michigan that aren’t publicly listed. This direct line to hidden deals can greatly boost your investment portfolio. Attending local real estate investment groups and meetups is another effective approach. These gatherings not only provide valuable insights but also referrals from seasoned investors who might steer you toward lucrative off-market properties.

Harness the power of social media platforms and online forums focused on real estate investing. These digital spaces are ripe for building relationships with fellow investors and receiving leads on off-market properties in Michigan. Engaging in these communities can result in unexpected, yet profitable opportunities.

Consider implementing direct mail campaigns targeting select neighborhoods. This method reaches motivated sellers who haven’t listed their properties, opening doors for off-market negotiations. Tailor your outreach to specific areas where you’ve identified potential. Finally, explore local property tax records and foreclosure notices. While this strategy borders on examining distressed properties, it’s still a viable avenue for discovering favorable off-market deals before they hit the market.

Exploring Distressed Properties

Why focus on distressed properties when seeking off-market real estate deals in Michigan? Distressed properties often present unique opportunities due to their financial issues, legal troubles, or significant physical damage. This makes them prime candidates for investors looking to capitalize on off-market deals. In Michigan, you can locate these properties by scouring local property tax records, foreclosures, and auctions. These sources reveal opportunities that aren’t available through traditional listings, giving you a competitive edge.

The state boasts approximately 86,666 off-market properties, many of which are distressed. Sellers of such properties are typically motivated by urgent circumstances, such as foreclosure or tax liens, making them more inclined to negotiate favorable terms. As a cash buyer, you’ll often find that these sellers are willing to accept lower offers, allowing you to secure advantageous deals.

To strategically pursue distressed properties, you must understand common distress factors. Recognize signs like impending foreclosure or existing tax liens. This insight enables you to evaluate which opportunities offer the highest potential returns on investment. By focusing on distressed properties, you position yourself to uncover valuable off-market opportunities in Michigan’s dynamic real estate landscape.

Michigan Market Trends

You’re witnessing a real estate market in Michigan marked by rising demand, where average home prices have surged by 10% over the past year. This intense demand fuels competitive bidding, particularly for off-market properties, as investors seek strategic advantages in a crowded market. Distressed property opportunities provide a unique edge, allowing you to negotiate favorable terms and bypass the typical frenzy found in traditional listings.

Rising Demand Insights

Amidst a tight real estate market in Michigan, the demand for off-market properties is surging due to rising home prices and low inventory, propelling both buyers and investors to explore alternative avenues. With average home prices rising by 10% year-over-year, the competitive landscape makes it challenging to secure listings through traditional channels. You’ll find that off-market properties offer a strategic advantage, bypassing the fierce competition typically seen in open market listings.

Investors are particularly zeroing in on distressed properties, seeing them as opportunities for renovation and lucrative returns. This focus intensifies the search for off-market deals, where buyers can negotiate directly with sellers and potentially secure properties at lower prices. Low inventory levels create a seller’s market, making it even more essential to tap into these hidden listings to avoid bidding wars.

Moreover, technology is transforming how you discover off-market properties. Innovative platforms provide access to unique listings not available through conventional means. Economic factors are also at play, with a shift towards creative financing strategies making off-market investments more appealing. By leveraging these insights, you can strategically position yourself to capitalize on Michigan’s dynamic real estate market.

Competitive Bidding Dynamics

In Michigan’s dynamic real estate market, competitive bidding dynamics have become a hallmark of current trends. As average home prices surge by 10% year-over-year, you’re witnessing intensified competition for available properties, especially within the hidden real estate sector. With low inventory levels creating a seller’s market, buyers are increasingly drawn to off-market properties, seeking alternatives to the conventional listings that often trigger fierce bidding wars.

Strategically, it is crucial to understand that off-market properties offer a unique edge. They provide a chance to bypass the typical publicized frenzies, allowing you to negotiate more favorable terms without the pressure of multiple bids. Yet, the growing interest in these hidden real estate gems means competition is still on the rise. Investors, keen to capitalize on renovation opportunities, are particularly targeting these undervalued assets.

Economic factors and market saturation further amplify the demand for off-market deals, as buyers explore creative avenues to secure properties. As you navigate this challenging landscape, adopting a detail-oriented approach to discover hidden real estate opportunities can be pivotal. By focusing on these less-visible options, you position yourself strategically in Michigan’s thriving, yet competitive, real estate market.

Distressed Property Opportunities

While Michigan’s real estate market presents challenges, it also offers strategic opportunities, particularly with distressed properties. With 86,666 off-market properties, many show distress factors like financial issues, poor condition, or legal troubles. These situations often involve foreclosure or tax liens, creating motivated sellers who are open to negotiation and potentially lower prices. As an investor, you can capitalize on these opportunities by exploring distressed properties as a gateway to profitable deals.

In Michigan, distressed properties are increasingly attracting investors seeking renovation projects. The average return on investment (ROI) for rental properties in urban areas can range from 8-12%. This makes distressed properties appealing for those aiming to maximize returns. In the Mid Michigan real estate market, where home prices have risen by 10% year-over-year, competition for these off-market deals has intensified. As a result, being proactive and strategic is essential.

Cash buyers often have an advantage in the distressed property sector. They can close deals faster than those relying on traditional financing, enabling them to secure undervalued assets swiftly. By understanding these dynamics, you can better navigate Michigan’s real estate landscape and seize lucrative opportunities.

Evaluating Property Risks

Understanding the risks associated with off-market real estate deals in Michigan demands a strategic approach, as these transactions often come with hidden challenges. Evaluating property risks is essential to guarantee that you’re making a sound investment. Start by diving deep into potential hidden issues, such as structural problems or zoning violations, which sellers might not disclose. This thorough investigation helps prevent unexpected surprises later on.

Due diligence is your best ally. Properties could be in foreclosure or embroiled in legal troubles, so meticulously reviewing financial records and property history is critical. This process not only safeguards your investment but also provides a clearer picture of what you’re getting into. Furthermore, the absence of comparable sales data for off-market properties complicates the evaluation of their market value, heightening the risk of overpaying.

Here are key points to keep in mind:

- Hidden Costs: Distressed properties might require extensive renovations, adding unforeseen expenses and time to your investment.

- Market Evaluation: Grasp local market trends and economic factors, as fluctuations in property values can considerably affect your return on investment.

- Legal and Financial Scrutiny: Verify all legal and financial aspects are scrutinized to avoid inheriting the previous owner’s troubles.

Additionally, distressed properties often demand considerable renovations. Be prepared for these additional costs, which can stretch both your budget and timeline. A strategic evaluation of the local market trends and economic conditions is essential, as these factors can heavily influence your investment’s success. By carefully reviewing these elements, you reduce the inherent risks and enhance the potential for a successful acquisition.

Networking for Deals

To access exclusive off-market real estate opportunities in Michigan, leverage the power of strategic networking. Begin by connecting with local real estate agents and investors. These professionals often have insider knowledge of properties not publicly advertised, granting you a competitive edge. Engaging with them can reveal valuable leads on off-market properties ripe for investment.

Next, consider joining real estate investment groups or clubs in Michigan. These networks are invaluable for fostering relationships with seasoned investors who frequently share insights and leads specific to off-market opportunities. The camaraderie and shared goals within these groups can greatly enhance your chances of discovering hidden gems.

Additionally, attending local real estate auctions and foreclosure sales is a strategic way to meet motivated sellers and like-minded investors. Such events are bustling hubs where networking can yield fruitful connections and potential deals. Here, you’ll find other investors actively seeking off-market opportunities, creating an environment ripe for collaboration and information exchange.

Don’t overlook the value of building relationships with property managers and contractors. These professionals can offer insights into distressed properties before they hit the market. Their firsthand knowledge is vital for identifying lucrative off-market deals early in the process.

Lastly, while social media platforms and online forums have their place, focus on face-to-face interactions and direct communication to cultivate trust and rapport. By strategically networking with key players in Michigan’s real estate scene, you’ll position yourself to uncover exclusive off-market deals, ensuring you stay ahead of the competition and maximize your investment potential.

Utilizing Online Platforms

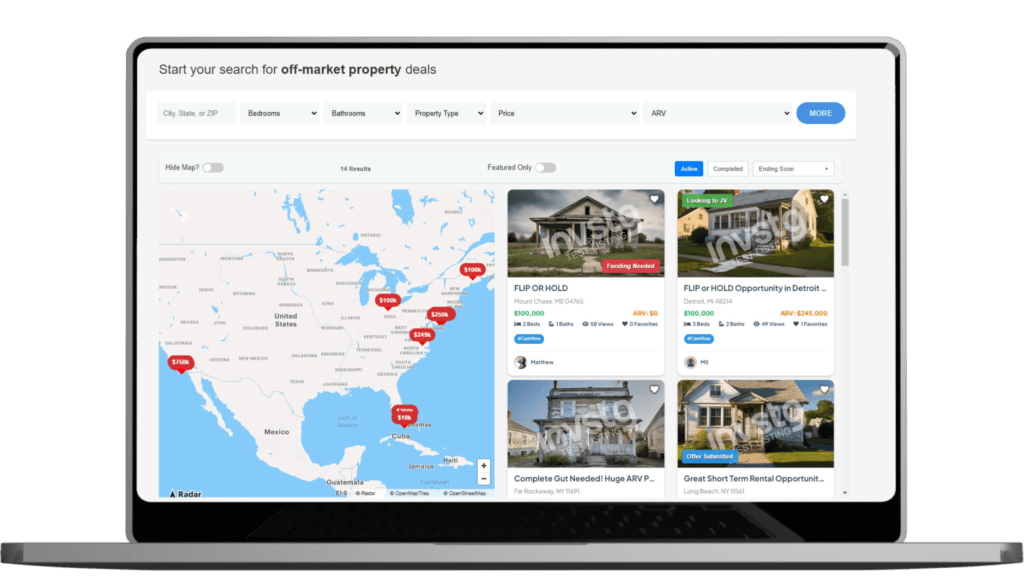

Expanding your network in the local real estate scene sets a solid foundation for uncovering off-market deals, but combining this with the strategic use of online platforms can exponentially enhance your search. Platforms like invstg and Foreclosure.com are treasure troves of off-market properties, including foreclosures and distressed listings. By accessing their extensive databases, you can gather valuable data that informs your investment decisions. These tools provide insights into property conditions, ownership, and financial history, all of which are essential for identifying hidden opportunities.

Expanding your network in the local real estate scene sets a solid foundation for uncovering off-market deals, but combining this with the strategic use of online platforms can exponentially enhance your search. Platforms like invstg and Foreclosure.com are treasure troves of off-market properties, including foreclosures and distressed listings. By accessing their extensive databases, you can gather valuable data that informs your investment decisions. These tools provide insights into property conditions, ownership, and financial history, all of which are essential for identifying hidden opportunities.

Mashvisor and BatchLeads take your search further by offering powerful tools for property analysis and direct outreach. They simplify identifying off-market opportunities in Michigan by allowing you to connect directly with potential sellers. This approach not only saves time but also increases your chances of securing lucrative deals by automating lead tracking and using data analytics to understand market dynamics.

DealMachine adds a unique dimension to your strategy with its “driving for dollars” approach. By tracking distressed properties while you explore neighborhoods, you can pinpoint off-market deals that other investors might overlook. This method, enhanced by technology, allows you to gather firsthand information and make informed decisions.

Leverage these platforms to:

- Streamline your search with automated lead tracking and marketing tools.

- Gain insights into local market trends and property values.

- Enhance negotiations by understanding seller motivations and financial backgrounds.

Legal Considerations in Michigan

When managing the intricacies of off-market real estate deals in Michigan, legal considerations are paramount to protect your investment. Understanding the state’s requirements for properties is essential. You must guarantee that property disclosures are complete, as they’re mandatory. Sellers must inform you of any known issues, which helps prevent future disputes. To safeguard your purchase, opt for title insurance. It shields you from unexpected ownership claims or disputes that could arise after closing.

Zoning laws in Michigan vary by municipality, and checking local regulations is significant. These laws determine how you can use or develop properties, affecting your investment strategy. Consulting with local authorities or a real estate attorney can provide clarity on what’s permissible, allowing you to make informed decisions.

Reviewing real estate contracts with a legal professional is critical to guarantee compliance with Michigan state laws. A thorough review protects your interests, minimizing risks associated with off-market transactions. Legal experts can identify potential pitfalls in contracts, ensuring all parties are aligned with state requirements.

Eviction laws also play a substantial role, especially if you’re investing in rental properties. Michigan’s specific legal processes for evictions, including proper notice and court procedures, must be followed meticulously. Understanding these laws helps you manage tenant issues effectively, preserving your investment’s value.

| Legal Aspect | Importance |

|---|---|

| Property Disclosures | Prevents future disputes |

| Zoning Laws | Affects property use/development |

| Title Insurance | Protects against ownership claims |

| Eviction Laws | Guarantees proper tenant management |

Financing Off-Market Purchases

Steering through the legal landscape is just one side of the equation; finding the right financing strategy for off-market purchases in Michigan is equally important. Traditional mortgages are a common route, but they require a credit score typically above 620 for favorable terms. While they offer stability, the process can be slow, which might not suit the fast-paced nature of off-market deals. Instead, you might explore hard money loans, which provide quick funding, allowing you to act swiftly and secure the property before other investors. These loans can be a game-changer in the competitive off-market space.

Seller financing is another strategic option worth examining. By negotiating directly with the seller, you can tailor payment terms to suit both parties, often leading to more flexible arrangements. This method not only streamlines the purchase process but also allows you to bypass traditional lenders altogether. First-time homebuyers might benefit from FHA loans, which provide lower down payment options, thereby easing the financial burden when acquiring off-market properties.

Understanding the financial landscape is essential. You need to stay informed about interest rates and market trends to effectively finance off-market real estate investments in Michigan. Here are some strategic points to keep in mind:

- Stay updated on interest rate fluctuations to optimize financing plans.

- Evaluate the speed vs. cost trade-off between traditional and hard money loans.

- Negotiate favorable terms through seller financing to benefit both buyer and seller.

Conclusion

In Michigan, about 20% of real estate transactions happen off-market, offering a strategic edge for savvy investors. By exploring these hidden opportunities, you can bypass competition and potentially secure properties below market value. Focus on networking, leveraging online platforms, and understanding local market trends to uncover these deals. Always evaluate risks thoroughly and consult legal experts to guarantee compliance with Michigan’s regulations. With careful planning and a strategic approach, you’ll maximize your investment potential in this dynamic market.