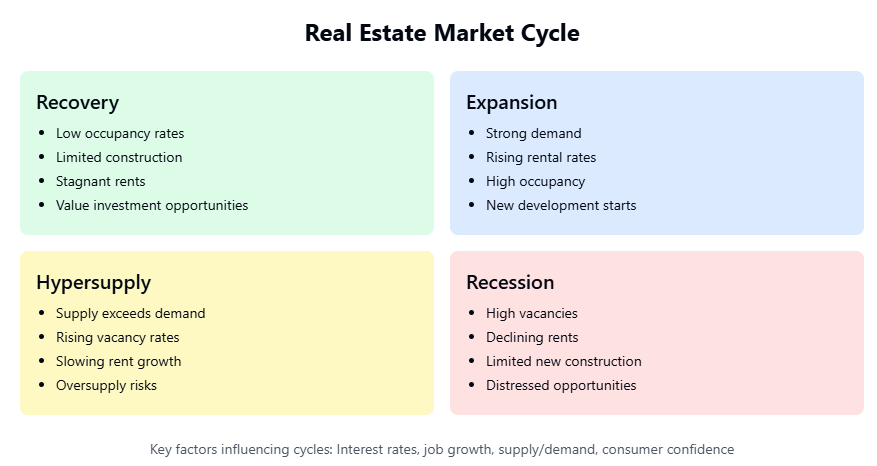

The real estate market cycle analysis consists of four phases: recovery, expansion, hypersupply, and recession. You’ll notice recovery features low occupancy and stagnant rents, while expansion brings strong demand and rising rental rates. Hypersupply leads to excess construction and higher vacancies, and recession sees declining rents and high vacancies. Key factors like interest rates, job growth, and consumer confidence shape these phases. Understanding these dynamics helps you align your strategies for optimized investments—deeper insights await.

Key Takeaways

- Real estate cycles consist of four phases: Recovery, Expansion, Hypersupply, and Recession.

- Recovery features low occupancy; Expansion sees rising demand and rental rates.

- Hypersupply leads to oversupply and declining rents; Recession involves high vacancies and price drops.

- Key factors include interest rates, supply-demand dynamics, economic growth, and consumer confidence.

- Investment strategies vary by phase, focusing on acquisitions during recovery and recession.

Real Estate Market Cycle Analysis

When you analyze the real estate market, it’s essential to understand its cyclical nature, which is divided into four phases: Recovery, Expansion, Hypersupply, and Recession. The real estate market cycle typically spans around 18 years, though individual cycles vary in length and intensity. During the Recovery phase, you’ll notice low occupancy rates and limited construction activity, making it challenging to pinpoint the start of an upward trend. As the market shifts into the Expansion phase, strong job growth and rising rental rates drive new developments, reducing vacancy rates and boosting investor confidence. The Hypersupply phase emerges when supply outpaces demand, leading to elevated vacancy rates and slowing rental growth. Finally, the Recession phase is marked by negative rent growth and increasing vacancies due to oversupply. By monitoring demand and supply dynamics, occupancy rates, and rental growth, you can tailor investment strategies across property types to align with each phase’s unique characteristics.

The Four Phases of the Real Estate Cycle

Four distinct phases define the real estate cycle: Recovery, Expansion, Hyper Supply, and Recession, each driven by unique supply, demand, and pricing dynamics. During Recovery, you’ll see low occupancy, stagnant rental rates, and opportunities for investment in undervalued properties. Expansion brings strong demand, rising rental rates, and high occupancy, making it ideal for development-focused strategies. Hyper Supply is marked by excess construction, rising vacancy rates, and slowing rent growth, signaling a need for risk mitigation. Finally, Recession features high vacancies and declining rental rates, demanding a focus on capital preservation. Understanding local market dynamics is crucial for aligning investment strategies with these phases.

Key Factors Influencing Real Estate Market Cycles

Real estate market cycles don’t operate in isolation; they’re shaped by a confluence of critical, interconnected factors. Key among these are interest rates, which directly affect affordability and demand—lower rates boost buying activity, while higher rates suppress it. Supply and demand dynamics also dictate price movements; oversupply leads to buyer-friendly markets, while scarcity fuels price appreciation. Economic growth and job growth is strong often correlate with increased demand, as higher employment levels enhance purchasing power. Consumer confidence further influences willingness to invest, shaping the phases of the real estate market. Demographic shifts, such as urbanization or aging populations, alter housing preferences and needs. Additionally, government actions like tax incentives or zoning laws can either stimulate or restrict market activity. These elements collectively determine the timing, duration, and intensity of real estate cycles, creating opportunities or challenges for buyers and sellers alike.

Investment Strategies for Each Cycle Phase

Understanding the factors that drive real estate market cycles equips investors to deploy tailored investment strategies for each phase. In the Recovery phase, you’ll focus on acquiring below-market value properties through wholesale, rehabbing, or buy-and-hold strategies, as prices remain low but begin to stabilize. During the Expansion phase, rising demand for space and declining vacancies make buy-and-hold, multifamily acquisitions, and new developments profitable. The Hyper Supply phase requires caution; you reduce exposure to new developments and prioritize a buy-and-hold strategy with sufficient reserves to weather potential market volatility. In the Recession phase, opportunities arise to acquire distressed assets, such as foreclosures or bank-owned properties, at deep discounts, positioning you for future gains as the cycle turns. Monitoring economic indicators like job growth and vacancy rates guarantees your strategies align with market dynamics, maximizing returns while mitigating risks across all phases. Building equity over time through strategic investments in each phase establishes a solid foundation for long-term financial growth.

Geographic and Asset Class Variations in Real Estate Cycles

While real estate market cycles follow general phases, geographic location and asset class can greatly influence their timing and intensity. Geographic location plays a pivotal role, as gateway markets often lead the recovery phase while secondary and tertiary markets lag. Similarly, asset class performance varies widely; suburban office spaces may thrive while urban office spaces face hyper supply due to differing demand dynamics. Even within the same area, industrial properties might outperform office assets, reflecting the localized nature of market cycles. This divergence in market dynamics underscores the importance of analyzing both geography and asset type when evaluating an investment property. Historically, not all markets align in their cycles—some cities recover while others experience oversupply. To optimize returns, you must navigate these nuances, leveraging insights into the interplay between geographic and asset-specific trends to position your portfolio effectively. Regional amenities can significantly impact the desirability and performance of properties across different locations and asset classes.

Conclusion

You can’t control the tide, but you can learn to surf. In 2008, the real estate market crashed, yet investors who bought at the bottom reaped massive gains. Understanding market cycles helps you anticipate shifts, much like reading weather patterns before a storm. While each phase—recovery, expansion, hyper-supply, and recession—presents unique risks, data-driven strategies position you to thrive. Geographic and asset class nuances matter; think globally, act locally, and adapt to the waves.