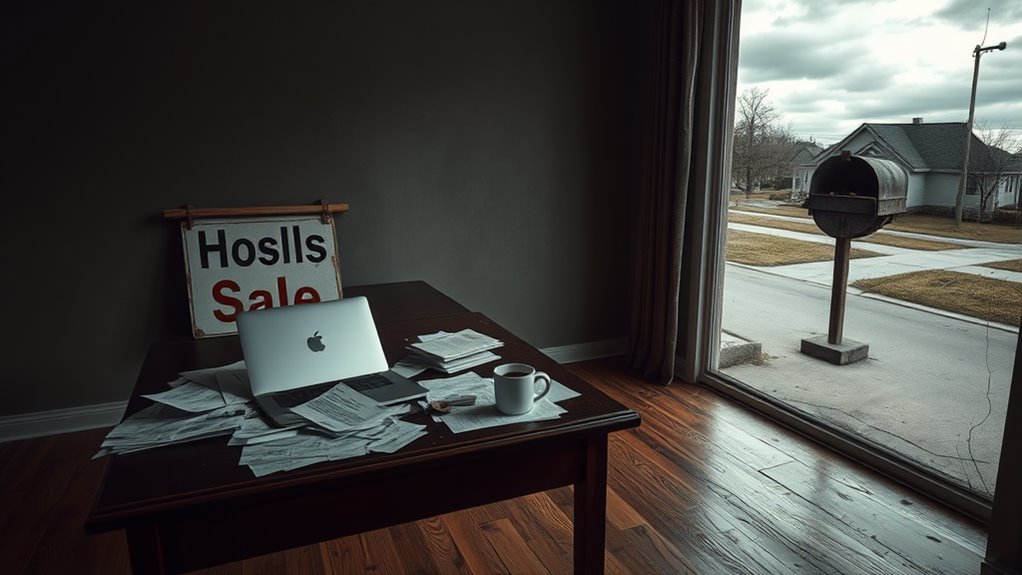

A short sale happens when you sell your home for less than the owed mortgage balance, requiring lender approval to proceed. It’s often used to avoid foreclosure and involves no profit from the sale. The process can take four months or more, and the property is sold “as-is,” potentially needing repairs. This option helps resolve mortgage debt during financial hardship. Understanding its details can prepare you for a smoother experience.

Key Takeaways

- A short sale is when a home is sold for less than the owed mortgage amount with lender approval.

- It helps homeowners facing financial hardship avoid foreclosure.

- Sellers receive no profit, and the sale price is less than the mortgage balance.

- The process typically takes four months or more and involves detailed financial documentation.

- Buyers purchase properties “as-is,” often below market value, but may face repair costs.

Short Sale Definition and Process

A short sale occurs when you sell your home for less than the amount owed on your mortgage, and it typically requires approval from your lender. As a homeowner, you may consider this option if you’re unable to make payments due to financial hardship and want to avoid foreclosure. In a short sale, your lender collects the sale proceeds, which are less than your mortgage balance. The difference between the sale price and the outstanding debt is called the deficiency. Depending on your lender’s policies, they may forgive this deficiency or pursue a deficiency judgment, requiring you to repay the remaining balance. The approval process involves your lender evaluating your financial situation and the property’s market value. While a short sale can provide relief, it’s crucial to grasp its implications, including potential credit impacts and financial obligations post-sale. State laws vary significantly on the permissibility and conditions of deficiency judgments, especially in nonjudicial foreclosure states.

Short Sale Eligibility and Requirements

While considering a short sale, you’ll need to meet specific eligibility criteria set by your lender, primarily centered on financial hardship and property value. Your home’s market value must be less than the outstanding mortgage balance, and you must demonstrate financial hardship, such as job loss or medical expenses, to qualify. Lenders will require a detailed financial statement documenting your income, expenses, and assets, along with recent pay stubs, tax returns, and bank statements. Additionally, you’ll need to submit a letter of authorization allowing the lender to communicate directly with your real estate agent. Here’s what you’ll face during the process:

- Emotional toll: Managing financial instability can feel overwhelming and isolating.

- Time commitment: Compiling and submitting extensive documentation demands patience.

- Uncertainty: Approval isn’t guaranteed, which can add stress to an already difficult situation.

- Vulnerability: Sharing personal financial details can feel invasive but is necessary.

Meeting these requirements is essential to move forward with a short sale. Consider exploring alternative investment opportunities like student housing that offer higher occupancy rates and consistent rental growth.

Short Sale vs. Foreclosure

You’ll find the process for a short sale involves negotiation with your lender, while foreclosure is initiated by them without your consent. A short sale typically impacts your credit less severely than a foreclosure, though both reduce your score. Understanding these differences helps you make an informed decision about your financial options.

Process Differences

Because short sales and foreclosures address financial distress differently, their processes diverge substantially. In a short sale, the homeowner initiates the process to avoid foreclosure by negotiating with the lender to sell the property for less than the owed balance. You’ll need lender approval, which can extend the timeline to four months or more. During this time, you can typically remain in your home. In contrast, foreclosure is lender-driven and often leaves you with little control. Once initiated, you face eviction, and the property is sold at auction or through the lender, often concluding within 120 days for nonjudicial types. Understanding these differences helps you navigate your options effectively. Note that during a short sale, lender consent is crucial, as it ensures the lender agrees to accept less than the full mortgage balance to resolve the debt.

- Stay in your home: Short sales allow you to remain during the process; foreclosures force you out.

- Negotiation: Short sales require lender approval; foreclosures bypass homeowner input.

- Timeline: Short sales take months; foreclosures can wrap up quickly.

- Control: You lead a short sale; a foreclosure strips you of control.

Credit Impact

The credit impact of a short sale versus foreclosure is significant, with both affecting your financial standing differently. A short sale typically lowers your credit score by 50 to 150 points, whereas foreclosure can drop it by 200 to 300 points. Lenders view short sales more favorably, as they reflect proactive financial management by borrowers. On your credit report, a short sale is marked as “settled” or “paid for less than owed,” while foreclosure is labeled as “repossession” or “foreclosure.” Both remain on your credit report for seven years, but a short sale generally has a less severe long-term impact. After a short sale, you may qualify for a new mortgage in as little as two years, while foreclosure can delay eligibility for up to seven years. Choose wisely to protect your financial future.

Buying a Short-Sale Home

When considering a short-sale home, it’s crucial to secure financing pre-approval early in the process to confirm your eligibility and strengthen your offer. Work with a mortgage lender to make sure you’re prepared for the financial commitment. Partner with a real estate agent experienced in distressed properties to navigate the complexities of a short sale. Research comparable properties recently sold within a 1⁄4 to 1⁄2 mile radius to ensure your offer aligns with market value.

- Heartbreak: Imagine falling in love with a home, only to face delays due to lender approval.

- Relief: Knowing you’ve uncovered potential property liens before making an offer.

- Empathy: Understanding the seller’s financial hardship while negotiating a fair offer price.

- Patience: Brace yourself for a lengthy closing timeline, as approvals can take months.

Always conduct a home inspection, even if the property is sold “as-is,” to identify hidden issues. Research comparable sales to make certain your offer aligns with market value. While the process can be lengthy, thorough preparation increases your chances of success.

Benefits of a Short Sale in Real Estate

Short sales offer several advantages for both sellers and buyers in distressed real estate transactions. If you’re a seller facing financial hardship, a short sale lets you avoid foreclosure, which can markedly impact your credit scores less severely. Lenders often cover real estate agent commissions, reducing your out-of-pocket costs. Additionally, you can resolve your mortgage debt without immediate legal action, providing peace of mind. For buyers, short-sale properties are frequently priced below market value, increasing the potential return on investment. Distressed homeowners are often motivated to sell, which can lead to quicker resolutions compared to lengthy foreclosure processes. Short sales are a practical solution for both parties, balancing financial recovery with opportunity. Consider leveraging real estate syndication to diversify your investment portfolio and mitigate risks.

| Benefit for Sellers | Benefit for Buyers |

|---|---|

| Avoid foreclosure | Purchase below market value |

| Less impact on credit scores | Higher return on investment |

| Reduced out-of-pocket costs | Motivated sellers |

| Quicker resolutions | Faster transaction process |

Drawbacks of a Short Sale in Real Estate

While short sales can provide financial relief, they also come with significant drawbacks that can affect both sellers and buyers. For sellers, the process is lengthy, often taking four months or more, and you won’t receive any profit from the sale. The price you sell for is less than what’s owed, and the market may not align with your expectations. Additionally, your credit score takes a hit, though it’s less severe than a foreclosure, which can limit future loan options. Buyers face challenges too, as short sale properties are usually sold “as-is,” potentially requiring costly repairs.

- No Profit for Sellers: All proceeds go toward the mortgage, leaving you with nothing.

- Tax Implications: Forgiven debt may be taxable income, adding financial strain.

- Credit Damage: Your credit score drops, impacting future financial opportunities.

- “As-Is” Condition: Buyers often inherit properties needing significant repairs.

A short sale may help avoid foreclosure, but it’s far from a perfect solution.

Short Sale Risks and Challenges

A short sale brings its own set of risks and challenges for both parties involved. As a seller, you face the possibility of deficiency judgments if the lender seeks the remaining mortgage balance after the sale. You may also experience a drop in your credit score, typically 85-120 points, though it’s less severe than a foreclosure’s impact. Additionally, you must provide proof of financial hardship to qualify for a short sale, and lender approval can take 3-6 months, deterring potential buyers. For buyers, properties are often sold “as is,” meaning you might inherit hidden issues or need costly property repairs. Lenders may also reject offers if they believe foreclosure could yield a higher recovery. Property buyers should also be aware of how local market conditions can influence the desirability and long-term value of the property.

| Risk/Challenge | Impact |

|---|---|

| Deficiency judgments | Seller liable for unpaid mortgage balance |

| Credit score drop | 85-120 point decrease |

| Lender approval delays | Takes 3-6 months |

| “As is” property condition | Buyers may face costly repairs |

| Lender rejection of offers | Short sale may not proceed |

Short Sale Strategies for Buyers and Sellers

Before pursuing a short sale, verify your financing is pre-approved and partner with an experienced agent to streamline the process. As a seller, gather detailed financial hardship documents, such as bank statements and a hardship letter, to demonstrate eligibility. Both parties should prioritize effective negotiation tactics to address timelines, disclosure terms, and potential financial implications. Ensure your pre-approval letter details are current to strengthen your position in the competitive market.

Buyer Financing Preparation

When preparing to buy a short sale property, securing pre-approval for financing is essential to demonstrate your reliability as a buyer and streamline the process. Work with a lender who understands the unique timeline of a short sale, as approval can take 60 to 90 days or longer. Research comparable property values to craft a competitive offer that aligns with the lender’s expectations. Make certain you have funds set aside for potential repairs, as short sales are often sold “as-is.” Partner with a real estate agent experienced in short sales to navigate lender negotiations and complex documentation. Utilizing financial projections can help you assess the long-term viability of the investment and ensure accurate budgeting.

- Show strength: A pre-approval letter makes your offer stand out.

- Be prepared: Plan for unexpected repairs and delays.

- Stay informed: Understand property values to avoid overpaying.

- Trust expertise: A skilled agent simplifies the process.

Seller Hardship Documentation

Since sellers must demonstrate financial hardship to qualify for a short sale, they’ll need to compile detailed documentation that supports their case. Start with a hardship letter explaining your financial struggles, such as job loss, medical expenses, or divorce. Include pay stubs, tax returns, and bank statements to substantiate your claims. If you’ve experienced an income reduction, provide proof like termination notices or disability documentation. Lenders may also want evidence of attempts at a mortgage modification or refinancing, so gather any related correspondence. Additionally, submit a detailed monthly budget showing your inability to meet mortgage payments. Thorough and organized hardship documentation strengthens your short sale application, increasing the likelihood of lender approval. Verify all paperwork is accurate and up-to-date to avoid delays in the process.

Effective Negotiation Tactics

How can buyers and sellers optimize their negotiation strategies in a short sale? Start by researching comparable sales and understanding the property’s liens to strengthen your leverage. A homeowner must be able to present detailed financial hardship documentation, including a compelling hardship letter, to justify the short sale and expedite lender approval. Buyers can stand out by offering faster closing timelines or higher earnest money deposits. Engaging a skilled Real estate agent can help navigate the complexities of the foreclosure process and guarantee your offer aligns with the home value.

- Empathy: Show compassion for the short seller’s situation.

- Preparation: Arm yourself with data on recent sales and liens.

- Speed: Demonstrate urgency to streamline the negotiation.

- Expertise: Leverage an estate agent’s experience to secure a fair deal.

Short Sale Alternatives and Mistakes to Avoid

If you’re considering a short sale, you should first explore alternatives that could help you avoid it. A loan modification can adjust your mortgage terms to lower payments, while refinancing might secure a lower interest rate or extend the loan term, making payments more manageable. A deed in lieu of foreclosure allows you to voluntarily transfer ownership to the lender, avoiding a short sale entirely. Forbearance agreements offer temporary payment reductions or pauses, helping you navigate periods of financial distress. In some cases, a bankruptcy filing can delay or halt foreclosure proceedings, giving you time to stabilize your finances.

When exploring options, avoid common mistakes like ignoring communication with your lender or failing to document all financial hardship evidence. Here’s a comparison of alternatives:

| Alternative | Benefit |

|---|---|

| Loan modification | Reduces monthly payments |

| Refinancing | Lowers interest rates or extends loan term |

| Deed in lieu of foreclosure | Avoids short sale and foreclosure proceedings |

| Forbearance agreements | Temporarily reduces or pauses payments |

Conclusion

Maneuvering a short sale can feel like walking a tightrope—balance is key. You’re juggling eligibility, risks, and potential rewards, all while racing against time. Whether you’re a buyer or seller, understanding the process empowers you to make informed decisions. Like a puzzle with missing pieces, missing details can trip you up, but with the right strategy, you can emerge unscathed. Approach it cautiously, arm yourself with knowledge, and you’ll steer clear of pitfalls.